21

Oct, 2016

21

Oct, 2016

The Plumbing Game, the Misleading WSJ Article False Narrative, and The Real Story

This morning we want to alert you to an article in the Wall Street Journal titled A Nasdaq Speed Upgrade is Threatening IEX. The article is about how NASDAQ is speeding up the SIP for Tape C securities, which it operates. It’s about how a participant to a trade on IEX will therefore know about its fill faster through the SIP than through IEX as a result. The implication/conclusion is that such a trader might be able to then race to other away exchanges in a race, and “beat” an order routing to sweep the market originating at IEX, thereby disadvantaging that order. Here are some quotes from the article:

– “The fact that this shortcut is out there does negate to a certain extent IEX’s whole model.” (Greenwich Associates’ Richard Johnson)

– “Very rarely has data been available through the SIP faster than it has these proprietary feeds. There is definitely some possibility that it will be gamed.” (Maystreet LLC’s Patrick Flannery)

The article is curiously misinformed and this note will explain for you why.

The False Story

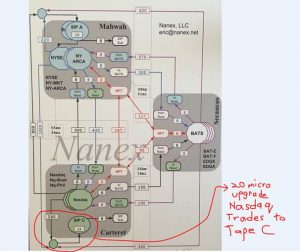

Look at the chart above, created by Eric Hunsader at Nanex, which describes the plumbing between exchange data centers before NASDAQ’s SIP upgrade. We highlighted the portion in red pen, where a trade done on NASDAQ will hit Tape C SIP in 255 microseconds, and that after the upgrade its goes to just 20 microseconds. This is a change that affects trades done on NASDAQ, and how fast those trades are reported to the Tape C SIP. With regard to trades done on a NYSE exchange, a BATS exchange, or IEX, nothing has changed. Zilch. Zero!

In other words, this story about a Nasdaq SIP upgrade is not an IEX story! The story is about Nasdaq, who after years of running a slow SIP, has finally upgraded it. This will benefit Nasdaq since their share of quote revenue should spike higher since they will updating their quotes faster than any other exchange. Only trades executed on Nasdaq in Tape C securities will have this benefit.

The IEX speed bump still remains very effective for most other trades/quote updates. As a matter of fact, this is easily observed. Nasdaq has actually performed its upgrade already, and it’s been in place since August 8th! If the WSJ author’s premise, that Nasdaq’s SIP upgrade is a threat to IEX as it disadvantages IEX router users, then he would be able to see IEX’s router success rate drop.

It looks like the WSJ article’s author did not do all of his homework. If he did he would have looked at IEX’s website, and specifically at its router success statistics. He would have seen that IEX’s success has not dropped. These are stats taken this morning from IEX’s website:

Yes – those fill rates are in the high 90s. Even the routes to Nasdaq. For those of you who monitor these rates, IEX’s stats are near industry top-of-class.

And here are Themis IEX router success rates from August, and from October MTD:

If the WSJ author’s thesis was correct, then our October routing stats would have fallen off as compared to August. They have not; in fact, they have risen.

Why did the author not reach out to IEX to get a quote? Did he not reach out to Brad or Ronan?

We did, and this is what they told us:

Brad:

- For the first time in history someone taking in the SIP can get information before someone taking a direct feed!

- Ironically, the IEX Router changed as part of the exchange application process – we now route to it over a speed bump while spraying other markets. Therefore, there is an EXTRA 350 microsecond delay from the initiation of the all routes for the trade to hit IEX, which then gets passed to the SIP. So a faster SIP means NOTHING! Our router fill rates are still high 90’s.

- IEX’s “whole model” can’t be negated by a faster sip for tape c securities. DPEG has nothing to do with that. Neither does the speed bump. Neither does the fact we don’t pay rebates, or have specialized order types.

Ronan:

- The coil design for the delay on the way out was always to protect prints on IEX being used as signals for fading.

- If our dissemination to Carteret takes 200 micros (rounding the numbers a tad) and NSDQ adds 50 micros, then someone can read Tape C prints from IEX in 250 V’s 350 in Secaucus. So what?

- As it relates to client order protection? If the broker is sweeping the exchanges in a reasonably effective fashion, their order to IEX still takes 350 to get to us, a 100 to match and then 200 to Carteret + 50 for the new SIP = 700 micros approx..

- If they have not already arrived at NSDQ within that 700 micro window, they have to be sequentially routing and we can’t protect against stupidity.

I guess my question is, so what that they know Tape C names faster in Carteret than they do in Secaucus. There was no issue with people knowing them today in Secaucus quicker than Carteret. What am I missing?

Pity. The author could have saved all that time writing this false narrative by just calling Brad or Ronan.

But wait… Not So Fast…

Not only has the author somehow been duped into thinking the “NASDAQ SIP Upgrade” story as an “IEX is Threatened” story, he misses the Real Story!

The Real Story

You may recall from one of our recent notes (September 14th) that NASDAQ has recently proposed to rope off the SIP in some new third party connectivity scheme, and start charging for it. BATS called Nasdaq out on this silliness, as did Virtu. Read their comment letters; they are both excellent.

The Real Story is that Nasdaq has upgraded the SIP to make it faster than some other direct feeds, so as to drive demand for this new faster SIP, all the while filing to start charging for it!

We feel bad the author missed the opportunity to see this story for what it is – a for profit exchange, with control of the SIP – a conflict of interest if there ever was one – scheming to create new ways to drive data revenue.

Pity. The author could have saved all that time writing this false narrative by just calling Brad or Ronan. Or perhaps by reading between the lines, and not relying on whomever fed him the “scoop” on this false IEX story line. The author could have asked himself who stood to benefit from the NASDAQ SIP Upgrade:

– NASDAQ benefits by creating an advantage in Trading Tape C securities where it would get to the NBBO quicker than other exchanges, and according to SIP revenue sharing formulas, gain a large share of SIP revenue.

– NASDAQ benefits by creating a new way to charge for the SIP in an unnecessary way.

– NASDAQ benefits if a false narrative that claims that trading on IEX is disadvantaged by a NASDAQ SIP upgrade, as potentially clients might divert order flow away from IEX and to its own exchange.

For-profit stock exchanges.

Whose businesses are really selling access and data.

Who have a responsibility to maintain the public SIP.

Who have a conflict of interest, as they sell fast market data, while having to maintain that SIP.

Yup – The Real Story.