24

Oct, 2017

24

Oct, 2017

The Real Reason Why A New Stock Exchange Speed Bump Was Just Approved

Yesterday we wrote about the SEC’s decision to approve the Chicago Stock Exchange’s new speed bump known as the “LEAD”. We questioned why the SEC would tilt the playing field and give market makers yet another advantage. Today we would like to bring up a couple of more points about the approval:

1) Market Data Revenue – The LEAD speed bump is another market maker subsidy which is on par with enhanced rebates that market makers currently receive. Why would the CHX want to further subsidize their market makers with this speed advantage? One reason could be that the CHX would like to earn more market data revenue. When Reg NMS was implemented in 2007, the SEC changed the way they calculate each exchanges market data revenue allocation. Market data revenue rules were modified to reward market centers for trades and quotes as opposed to just trades. The formula for the splitting of the estimated $500 million/year market data pot is based on 50% trades and 50% quotes at the national best bid and offer. The CHX notes this on their website :

“Market Data Revenue is allocated among the exchanges and FINRA based on the competitive quotes (Quote Revenue) and trades (Trade Revenue) each reports. Quote Revenue is earned when a trading center displays a competitive quote whether or not the quote results in a trade. Trade Revenue is earned whenever a trade occurs.”

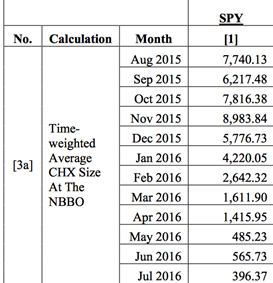

If a CHX market maker has a 350 microsecond head start, they are likely to generate more quotes for the CHX since they would be able to quote with much less of a chance of getting adversely selected by a faster market participants. When the CHX first proposed a speed bump in September 2016 (it was then known as “LTAD”), they included a chart of CHX quotes at the NBBO for the SPY ETF. Notice the dramatic drop off in CHX quoted size beginning in early 2016:

The CHX blamed latency arbitrage for this decrease in quote size. Apparently, some high speed traders figured out a way to game the CHX market maker quotes and soon after the CHX market makers drastically reduced their quoting activities. The newly approved LEAD speed bump should get these quotes back and therefore should also increase CHX’s quote revenue allocation.

2) The Chinese problem – We find it very curious that this controversial speed bump was approved less than a month after news broke that a mystery bidder for the Chicago Stock Exchange, known as Exchange Capital LLC, was trying to block the sale of the CHX to a Chinese-led investor group. The Chinese investor group has apparently grown frustrated with the long SEC approval process and two of their investors, Chongqing Jintian Industrial Co., Ltd. and Chongqing Longshang Decoration Co., Ltd, have reportedly just pulled out of the deal. Who is the mystery bidder known as Exchange Capital LLC? Did the SEC approve the LEAD proposal as a reward for this group to step in and help block the politically controversial Chinese deal? We don’t know the answers but the timing does look quite suspicious.