25

May, 2018

25

May, 2018

Investigating The Crypto Cheaters

The US Justice Department has just launched an investigation into the manipulation of cryptocurrency prices. According to Bloomberg :

“The illicit tactics that the Justice Department is looking into include spoofing and wash trading — forms of cheating that regulators have spent years trying to root out of futures and equities markets, the people said. In spoofing, a trader submits a spate of orders and then cancels them once prices move in a desired direction. Wash trades involve a cheater trading with herself to give a false impression of market demand that lures other to dive in too. Coins prosecutors are examining include Bitcoin and Ether, the people said.”

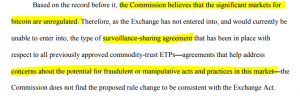

This investigation doesn’t surprise us at all considering that the same HFT players that have operated in the equity markets for years are also operating in the crypto market. Along with these HFT players, exchanges like the Cboe have also been pushing full steam ahead into the crypto world. After somehow convincing the CFTC to allow them to list bitcoin futures, the Cboe has been busy lobbying the SEC to permit bitcoin ETF’s. But the SEC has rightfully pushed back noting that the lack of surveillance and regulation of the underlying bitcoin exchanges is a major problem. Last year, the SEC issued this response to a Cboe bitcoin ETF proposal :

The SEC knew then that the underlying crypto market was filled with bad actors and thankfully they saw through the profit-motivated arguments of exchanges like the Cboe and NYSE Arca who continue to push for a bitcoin ETF. These exchanges should not have even proposed a bitcoin ETF since the underlying spot market still does not have robust surveillance system. But they seem to care more about their own bottom line rather than investor protection.

The CFTC also just recently issued an advisory for cryptocurrency products where they suggested more surveillance for the underlying cryptocurrency spot market:

“Commission staff believes that a well-designed market surveillance program of an exchange (i.e., a DCM or SEF) for virtual currency derivatives includes an information sharing arrangement with the underlying spot market(s) that make up the cash-settlement price to facilitate the exchange’s access to a broader range of trade data.”

After the Bloomberg story broke yesterday, Bloomberg called us and asked our opinion of the DOJ investigation. Here is what we said:

Themis Trading LLC partner and co-head of equity trading Joseph Saluzzi said there should be cross-market surveillance in crypto markets to stop these practices.

“The issue is that there is no one regulator monitoring the underlying exchanges and therefore there is no way to know if manipulation like spoofing is going on,” Saluzzi said in an email. “Some exchanges will say that they have information sharing agreements with each other, but again this is not enough to ensure that manipulation is not occurring. As we have seen in the equity market, exchanges are for-profit and can not be trusted to police themselves.”

Hopefully, the DOJ and the CFTC will force the crypto exchanges to clean up their act. But until they do – investors beware.