13

Aug, 2018

13

Aug, 2018

Don’t Believe The Institutional Crypto Hype

Barely a day goes by when we don’t see an article that claims there will soon be a boom in institutional demand for cryptocurrencies. CNBC recently ran an article that proclaimed “Goldman Sachs-backed Circle sees boom in crypto demand from institutional investors, despite bear market” In addition to the media hype, there continues to be a litany of Wall Street and regulatory veterans that are flocking to crypto. The latest announcement was that former SEC Chairman Arthur Levitt has joined the board of Ominex , a crypto trading platform.

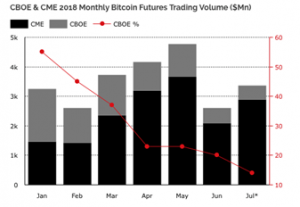

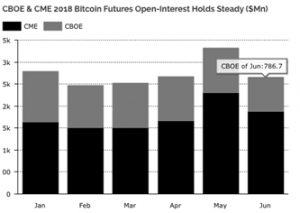

While exchanges and market makers continue to hype the potential for crypto markets, the fact of the matter is that there still is very little institutional demand for crypto products. Here are some charts from Diar that show the slow growth of bitcoin futures trading volume and open interest:

These markets may be in search of institutional investors but, as evidenced by the futures volume, institutional investors are still not in search of them.

We don’t dispute that there is certainly a tremendous amount of retail interest in the crypto markets. These retail crypto traders are an enthusiastic bunch who seem to truly believe in their market and are hoping that the SEC will soon approve a bitcoin ETF. Their hope seems to be that if a bitcoin ETF is approved then a bull market will follow and bail them out of their underwater crypto positions. They recently made their voices heard on the latest bitcoin ETF proposal and submitted over 1300 mostly supportive comment letters . This Reddit post pretty much sums up their hopes: “If Bitcoin ETF gets approved, we will be looking at the biggest crypto bullrun ever.”

While Wall Street insiders and crypto speculators continue to hope for more crypto derivatives, questions remain about a major source of crypto liquidity. The WSJ just published an article titled “The Mystery Behind Tether, the Crypto World’s Digital Dollar” which questions the whereabouts of billions of U.S. dollars that are supposedly backing a cryptocurrency known as Tether. The WSJ points out that Tether has never produced an audit showing it has the cash reserves which are supposed to be backing the cryptocurrency:

“But Tether has never produced an audit showing it has the purported reserves. The company that controls tether maintains it has the reserves, yet it has never named the banks it uses to hold these funds, nor said where they are based and regulated.”

Meanwhile, there is still an active investigation by the CFTC into Tether and an exchange known as Bitfinex which is apparently very closely associated with Tether.

Bottom line here is that there is still a tremendous amount of questions by regulators about the crypto world. According to the WSJ:

“Some investors say tether has become systemically important within the cryptocurrency market. “There are a couple of forces in this market that if they failed, it would be catastrophic,” said Ding’An Fei, a managing partner at Ledger Capital, a digital asset investment firm in Beijing. “Tether is one of them.”

The potential for a major crypto disaster exists and yet stock exchanges and market makers are still asking to create derivatives on a product that may implode at any time. We understand that exchanges like NYSE are profit motivated and want to increase their shareholders wealth but last we checked they still do have some regulatory responsibilities.