15

Jan, 2016

15

Jan, 2016

“Robin Hood – The Legend Of Internalization”

It seems like a trend has been forming in the industry with free to almost free brokerage commissions for retail clients. About a year ago, we wrote about Robinhood, the new retail trading app which targeted millennials by offering free trades. You might remember that Robinhood was started by a couple of young Stanford grads who wanted to “democratize access to financial markets.”

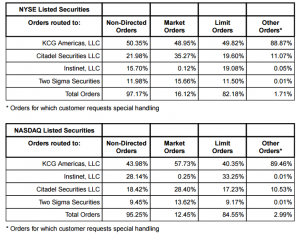

At the time, we questioned Robinhood’s business model, particularly if they would be selling their retail order flow to internalizing market makers like Citadel. Now that Robinhood has been in business for over a year, we can take a look at their 606 Reports and see exactly where they are routing their retail flow and it’s even worse than we suspected. Robinhood routes ALL their flow through their clearing broker Apex who then sells ALL of this flow to brokers including: Knight, Citadel, Instinet and Two Sigma Securities. Here is a link to their 606 report

Apparently Robinhood’s model is attracting competitors and a new low commission firm called Ustocktrade has just started up. Ustocktrade was started by a former executive of the London Stock Exchange who had previously overhauled the LSE’s trading platform. Ustocktrade charges very attractive rates – $1/month membership fee and $1/trade fee to subscribers but caps orders at $10,000 in market value. Reuters recently described Ustocktrade’s business model:

“The brokerage does not send orders to other trading platforms. To help get trades get done, Ustocktrade is enlisting “superusers,” that will be the counterparties to trades that do not have a natural match. There is only one superuser so far, but Ustocktrade is currently in talks with two or three others, Weeresinghe said. He declined to name of the superuser, but said the person or firm is obligated to not let any transactions fail during trading hours, and will trade for free in return.”

Who is this superuser that is trading on the other side of all these retail orders? We scanned through the Ustocktrade customer agreement and found the answer:

“Super users may not be able or willing to fill marketable customer orders in volatile or thinly traded markets or in other difficult market conditions. As such, super users are not guarantors of liquidity or trade execution. As noted above, the internal-only trade fulfillment nature of the Trading System means that My orders may not be executed or executed on a timely basis. These risks are higher due to the fact that currently there is only one super user, the CEO and 100 percent owner of Ustocktrade Securities’ direct owner, Ustocktrade, LLC (“Parent”).

Yes, you read that right. The other side of every trade is the parent company of Ustocktrade. The customer agreement further goes on to disclose more about their proprietary trading:

“Ustocktrade Securities Proprietary Trading – I understand that You may trade Your own capital for Your own proprietary account. This creates a conflict of interest for You. However, such trading is not conducted through the Trading System and associated persons of Ustocktrade Securities engaged in trading the firm’s own capital are not permitted to use trading information from the Trading System in trading the firm’s proprietary account.”

The centuries old story of Robin Hood is about a man who robs from the rich and gives to the poor. It looks like these new “free” brokerage apps may have gotten that story backwards.