22

Oct, 2018

22

Oct, 2018

“Broken Markets” Had It Right

“Over the past decade, the stock exchange business has undergone a radical transformation. What was once a nonprofit, quasi-utility, member-owned duopoly has turned into a for-profit, fragmented, and extremely competitive business with 13 exchanges…Normally, if a business model opened itself to competition, this would be viewed as a good thing. It would enable free markets to work. However, the stock exchange business has more responsibilities than profit. It has to facilitate capital formation for companies and to protect individual investors. Unfortunately, the new for-profit landscape has caused the exchanges to forego these responsibilities in order to focus on the bottom line.”

- Sal Arnuk and Joe Saluzzi, “Broken Markets”, 2012

We wrote the above words six years ago and until recently not much had changed in the stock exchange business. But over the last year, there has been a very noticeable shift in how regulators and the courts are viewing the stock exchange business. Market data fees and rebates are now in the crosshairs of the SEC while the courts are challenging the concept of exchange immunity. The modern stock exchange model, which was born out of Reg NMS, is now under attack.

The market structure debate, which for years was played out at industry conferences and regulatory roundtables, is now front page news again. Last week the WSJ published an article titled “NYSE, Nasdaq Take It on the Chin in Washington” which did a great job of highlighting the problems that the major stock exchanges are now facing. The WSJ wrote:

“The exchanges, including the New York Stock Exchange and Nasdaq Inc., were once powerful interests in Washington. And for decades the SEC deferred to the exchanges and didn’t dictate the plumbing of markets. That started to change in the late 1990s and early 2000s as a mix of new regulations and technology-driven competitors challenged the slower NYSE, leading to more competitive trading and erosion of NYSE’s power and market share…Now the tide appears to have turned, with the SEC taking a more forceful stance on key aspects of the exchange business.”

The exchanges did this to themselves. For years, they catered to the high frequency traders and bent over backwards to give them anything they wanted including higher rebates and conflicted order types. They chose to chase profits and forgot about their original purpose of facilitating capital formation and protecting individual investors. Now, it’s time to either change their model or have the regulators change it for them.

Later this week, the SEC will be hosting a two day Roundtable on Market Data and Market Access . While we’re glad to see some of our institutional investor friends on a couple of the panels as well as our friends from IEX, we were disappointed that authors of “Broken Markets” were not asked to participate. Either way, we’re happy that the SEC is putting this topic under the microscope and we’re proud of the fact that we were one of the first to publicly speak out and highlight the conflicts of interests at the major stock exchanges.

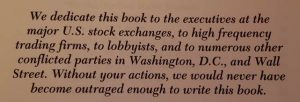

We would like to end our note today with a reprint of our dedication page from “Broken Markets”: