21

Dec, 2018

21

Dec, 2018

SEC Adopts Transaction Fee Pilot

The SEC has announced that it has voted to adopt new Rule 610T of Regulation NMS to conduct a Transaction Fee Pilot in NMS stocks. The pilot is structured extremely well and we believe the final data will prove that rebates are not needed to generate liquidity. We have to thank the folks at the SEC, particularly Director Brett Redfearn, for having the courage to publish the access fee proposal and then to stand up to the conflicted status quo, entrenched interests and approve a final rule which kept most of the proposal intact. The current SEC, under Chairman Jay Clayton, has done more for market structure reform in less than two years than the prior two SEC Chairs did during their entire tenure. Just this year alone, the SEC adopted amendments to Reg ATS which will increase transparency and oversight of ATS’s, created new rules to increase order handling transparency and now has approved the transaction fee pilot. Bravo SEC…Bravo!

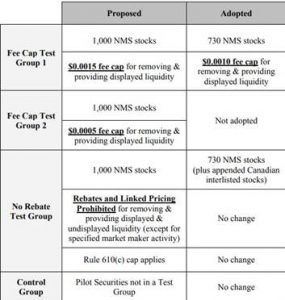

Even though the major exchange families (NYSE, Nasdaq and Cboe) put on a full court press (even threatening litigation) to try and defeat the access fee proposal, there were very few changes in the final rule compared to the original proposal. Here is a chart of the proposal vs the adopted rule:

The final rule is actually simpler than the original proposal:

– Since it eliminated one of the three test buckets, there will be two buckets of 730 securities each.

– One bucket will have an access fee cap of $0.0010/share (current fee cap is $0.0030 share) and the other bucket will keep the existing $0.0030/share fee cap but eliminate rebates.

– the pilot will last for one year but the SEC has an option to extend it to two years

– the pilot will cover both lit and dark trading at exchanges only and will not cover ATS’s or off-exchange trading.

– The pilot will require that exchanges post on their public websites fee and rebate data on a monthly basis.

While access fees may not be transparent to most institutional and retail investors, we can assure you that most brokers care very much about access fees and rebates. Every $0.0001/share matters when it comes to the routing of billions of shares per day and numerous conflicts of interests have been formed over the last decade to ensure that routers have been built to minimize cost and maximize rebates. We believe that the Rule 610T is about to turn the process of order routing upside down.

We have been pushing hard for the elimination of all payment for order flow for the good part of the last decade. It was a key theme in our book “Broken Markets” which was published in 2012. This fight hasn’t been easy since we have had to constantly battle the big exchanges, conflicted brokers, conflicted industry consultants and the rebate-hungry high frequency traders. These groups have deep pockets and have often used their political influence to sway opinion at the regulators for years. Thankfully, a few years ago, an honest exchange by the name of IEX was formed and we have been honored to fight shoulder to shoulder with them for the elimination of rebates.

We expect that status quo groups who fought the transaction fee pilot will not just roll over and give up. However, the pendulum continues to tilt away from the status quo and towards the direction of market structure reform. We’re thrilled that we were able to help in this process and we will continue to do our best to make sure the pendulum doesn’t swing back the other way.