22

May, 2019

22

May, 2019

Don’t Sue Your Regulator

The SEC is pressing ahead with the Transaction Fee Pilot (TFP) even as the exchanges continue to try to slow them down through the courts. Last night, the SEC announced that pre-Pilot data compilation period will begin on July 1, 2019 and will end on December 31, 2019. This means that, even though there is still pending litigation, stock exchanges must begin collecting data for the pilot.

We’re glad to see the SEC pushing back hard at the exchanges and still believe that the lawsuit that NYSE, Nasdaq and Cboe filed against the TFP was a bad idea. Their strategy is most likely to try to tie up the SEC in court for years and hope that a new Chairman might be named in that time who might have a different opinion of the TFP. Good luck with that.

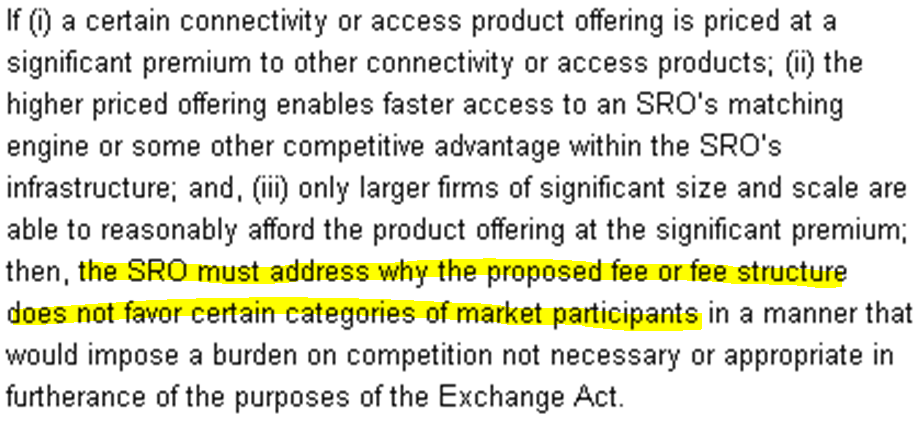

In addition to naming the start date of the TFP, the SEC also issued guidance yesterday on exchange fee filings. Specifically, the SEC wants the exchanges to justify proposed new fee increases and have issued clear guidance on what the exchanges must do to comply:

“This guidance discusses several aspects of Fee Filings, with a focus on how SROs can ensure that they have clearly described their proposed fees and addressed how they satisfy Exchange Act requirements that, among other things, fees be (i) reasonable, (ii) equitably allocated, (iii) not unfairly discriminatory, and (iv) not an undue burden on competition.”

The FT quoted a SEC spokesman as saying, “Exchanges must provide detailed information to substantiate fee increases and prove there are competitive forces in the market for exchange data.” Basically, this means the SEC just tightened the screws on the major exchanges who for years simply submitted fee increases without much justification. One area that the SEC focused on was the cost of connectivity :

The major exchanges have argued that they don’t have monopoly power but market participants have had no choice but to pay their prices. For years, exchanges simply raised their market data fees through fee filings that rarely received public comments. Well, the SEC just threw a wrench in that scheme and it seems that raiding the market data piggy bank won’t be that easy anymore.

Maybe suing your regulator was not such a good idea after all.