18

Sep, 2015

18

Sep, 2015

The Risks That Lie Beneath The Surface of The Exchange Traded Product Market

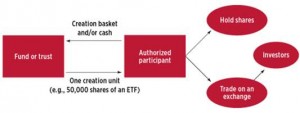

Back in June, the SEC published a “Request for Comment on Exchange-Traded Products” where they asked commentators to respond to 53 questions about the structure of exchange traded products (ETP’s) which included questions about the ETP arbitrage mechanism and the creation/redemption process. So far there have been 38 comment letters filed. In light of the ETF flash crash of August 24th, we thought we would take another look at these letters to get a sense of what commentators were saying about the structure of ETP’s.

Many of the letters were filed before August 24th and had the general tone that the structure of ETP’s was safe and secure. We would like to focus today on two of the comment letters which were written by high frequency trading market makers –Jane Street and Flow Traders . These market makers issued some warnings about the trading and pricing of ETP’s:

Jane Street – Jane Street was concerned about potential capital requirement problems in the creation/redemption process in times of high volatility, the need for more Authorized Participants (AP’s) and the problems that could occur if a creation halt happens. Specifically, Jane Street wrote:

“In times of market turmoil, when available capital becomes tight, APs may curtail the amount of redemption transactions they are willing to effect which, in turn, will limit the amount of ETP liquidity provided at a time when it is likely needed to satisfy outsized demand and dampen market volatility. We would ask that the Commission and other regulatory bodies consider the possibility of providing APs and ETP market makers with certain capital relief solely in connection with their facilitation of creation and redemption transactions.”

“Like other market makers, Jane Street often is dependent on the creation process to make timely delivery in connection with sale transactions, as required by Rule 204. We would ask the Commission to consider the possibility of providing ETP market makers with certain additional relief under Rule 204 in instances when an ETP incurs a creation halt.”

Jane Street is asking the SEC to grant them and other market makers lower capital requirements in times of volatility and the ability for AP’s to magically create more ETP units during halts.

Flow Traders – Flow Traders also complained about capital requirements claiming that “it is currently highly capital intensive to trade certain ETPs.” They also warned that ETP pricing may be inaccurate when the underlying market is illiquid or extremely volatile:

“Investors expect intraday ETP trading prices to be very close to their contemporaneous value, usually within the creation/redemption cost for the instrument. For international ETPs or if not all underlying assets (or hedges) are tradeable at the same time for other reasons this can be wider, as well as in volatile circumstances. Same applies for equity index futures. Prices might not track the value of the underlying portfolio when the underlying market is illiquid or closed, when the ETP fund is closed for creations or redemptions or when there’s a sudden illiquidity in the ETP itself.“

Flow Traders also warned of price manipulation for ETP’s that have illiquid underlying assets:

“ETPs with less-liquid underlying assets could theoretically be more susceptible to manipulation as price formation can be more easily influenced in less-liquid markets (for instance marking the close to influence the price of an ETP). We believe that more-liquid ETPs are not susceptible to market manipulation.”

And finally, Flow Traders, opined about the state of the fragmented US equity market:

“In our view, the current fragmented market structure does not necessarily result in best execution for the investor. Before an order reaches the most liquid ETP exchanges (e.g. ARCA, BATS/EDGX, NASDAQ), it may go through a loop of venues with less liquidity (e.g. payment for order flow, dark pools, inverted exchanges) where certain market participants may have a first look at the order, sometimes in exchange for a fee. The question is if those executions are optimal for investors.”

We’re glad to see these HFT market makers have raised concerns about some areas of the ETP market but are concerned about the credit risk that they may pose to the market. We hope that the events of August 24th put some of these comments into perspective and that the SEC looks carefully at the risks that have formed in the ETP market. Granting capital relief to lightly capitalized, proprietary HFT market makers does not seem to us to be a prudent risk management measure.