17

Apr, 2017

17

Apr, 2017

Did You Know About The NYSE ARCA System Disruption on April 10th?

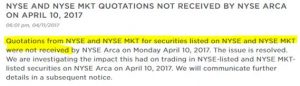

On April 11th at 6:01 pm, NYSE ARCA sent this Trader Update:

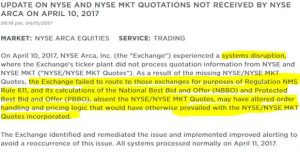

On Thursday, April 13th at 6:18 pm (right before a three-day holiday weekend), NYSE ARCA sent this follow up Trader Update :

You may have not known about this situation since NYSE tried to bury the news right before the three-day holiday weekend. While NYSE was successful in keeping the news from the media, we always read our “Trader Updates” and were very disturbed by their revelation.

Let’s take a look at what happened on Monday, April 10th:

NYSE ARCA did not read quotes from NYSE and NYSE MKT on April 10th. Apparently, since there were no intraday “Trader Updates”on April 10th, customers were unaware of the system disruption. Therefore, any customer that relied on NYSE ARCA’s routing ability might have been in violation of Reg NMS Rule 611 and might have received inferior prices than were available on NYSE and NYSE MKT.

For example, suppose the market is $10.10-$10.12. The offer of $10.12 is a NYSE offer. At $10.13, there is an offer of 500 shares on NYSE ARCA. A buyer comes in to ARCA and wants to sweep and post up to $10.13 using ARCA’s router. ARCA would have ignored the $10.12 offer, bought the 500 shares at $10.13 from ARCA and posted a bid at $10.13 for the balance.

There are two clear rule violations with the above example: Rule 611 trade-through violation and a locked/crossed market violation. In addition, NYSE ARCA’s system disruption also likely triggered a Reg SCI event. All of these violations could expose NYSE ARCA to substantial fines and penalties from the SEC.

We would like to ask NYSE ARCA these questions::

Did problem last all day?

Why didn’t they notify customers?

How many trade-throughs occurred?

How many locked/crossed markets occurred?

Quantify the damages for fills that received inferior prices than were available?

This situation highlights the fact that exchanges do act like brokers when routing customer orders. While this is a necessary function since they must adhere to Rule 611, we wonder if self-regulatory organizations should be acting like brokers? We are particularly concerned about NYSE’s routing function since they recently took back the surveillance role from FINRA. Is NYSE policing itself?

One final point: we do not believe that exchange immunity applies to this system disruption since the exchange was performing the function of a broker. Last November, the SEC filed an “amicus brief” in the City of Providence vs BATS Global Markets lawsuit and stated:

“The Commission is of the view that absolute immunity is properly afforded to the exchanges when engaged in their traditional self- regulatory functions—where the exchanges act as regulators of their members. We believe that immunity does not properly extend to functions performed by an exchange itself in the operation of its own market, or to the sale of products and services arising out of those functions.”

In other words, since this system disruption occurred when the exchange was not performing a regulatory role, then the exchange does not have absolute immunity. Since this disruption is likely a Reg SCI event, we believe that the SEC will get involved and more details will eventually come out as to what happened on April 10th. But why should NYSE ARCA customers have to wait to find out what happened? NYSE ARCA should immediately reveal more information about the April 10th system disruption and they could start by answering the questions that we listed above.