19

Feb, 2019

19

Feb, 2019

Big Three Exchange Families Sue the SEC to Protect Their Business Model

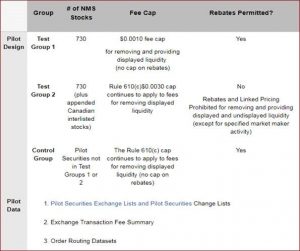

The SEC unanimously approved a pilot program in December called the Transaction Fee Pilot [sec.gov]. The purpose of this pilot is to test the effect on some of the distorted incentives in our markets on market quality, and includes a bucket of securities where rebates are banned. It’s a one year pilot with the option for the SEC to extend it to a second year. It includes three buckets or Test Groups, including a no-rebate bucket:

The three major stock exchange families that engage in paying rebates had hinted from the outset that they might sue to block this SEC pilot program, and they are now making good on that threat.

NYSE wrote an op-ed [wsj.com] explaining their intention on February 14th, and they were quickly followed by Nasdaq and the CBOE [wsj.com]. Nasdaq’s Nelson Griggs had this to say:

“‘Do no harm’ is clearly a mandate for the exchanges and the SEC, and this could certainly do harm.”

The CBOE also explained:

“The pilot is so intrusive, ill-conceived and likely to harm the equities markets, there was no choice.”

A former SEC lawyer who now teaches law at the University of Michigan, Adam Pritchard, commented:

“They will usually knuckle under and do what the SEC says,” Mr. Pritchard said. “This could be a big hit for their business model and that is why they resorted to a lawsuit.”

He also says the SEC is likely to prevail, as it authorized a temporary Pilot Program, instead of ordering that fees be changed permanently, but it is not a sure thing.

Our own Joe Saluzzi commented in the above Wall Street Journal article as well:

“If they don’t have rebates, their business model falls apart,” said Joe Saluzzi, a partner at brokerage Themis Trading and frequent critic of the big three exchanges. “It’s sad that the exchanges went down to this level.”

Of course Joe is right. The crux of the matter is this, essentially:

The public stock exchanges have morphed their business models so that half of their revenues are derived from selling special data feeds and colocation access to their order books. To ensure demand for these revenue streams, they create a race condition to every quote change in every stock and ETF all day long – a race condition for which they have essentially a monopoly to sell the products that ensure success in that race. Their business model is predicated on dividing the participants on their platforms, and arming one set of participants to take advantage of the others.

Whereas once upon a time the Exchanges used to make their money operating a market where they charged corporations to list their securities, and charged firms a flat fee trading those securities, they have since become for-profit public corporations themselves. Hence they need to continually grow revenue. They have figured out how to use technology to derive revenue from a new source – the creation of races in which they sell the means to win those races.

And when the Exchanges realized there was a natural ceiling that comes with tying their revenues to trading volumes, they started exponentially increasing and creating new fees related to the selling of speed. This has even led to revolt among the fast trading firms on its platforms, who have recently announced plans to build a new exchange [ft.com] – member owned and not publicly owned – to reduce those fees.

Won’t you please recall that Jeff Sprecher, the CEO of ICE (who owns NYSE) had this to say in the aftermath of the release of the Michael Lewis book Flash Boys [reuters.com]:

“Unfortunately it’s spread throughout the equities markets in the U.S. and we can’t unilaterally change it alone. But it’s certainly something we want to raise the profile and start a conversation around because I think it hurts everybody in the market.

I think maker-taker pricing or payment for order flow is bad for markets,” Sprecher said. “It creates false liquidity by attracting people who are there solely to try to make rebates and not actually trade and hold risk. That liquidity leaves quickly and is not subject to any contractual obligation like a market-maker would be.

It changes the relationships and incentives between a customer and its broker depending on whether the broker internalizes the rebate for the customer order. The relationship between a broker and a customer should be one of a broker having their interest aligned with their customers.”

Can you imagine the opening statement of the lawyers representing the SEC in these suits? Can you imagine how delicious the drama might be when they call Jeff Sprecher to the witness stand, asking him to reconcile his lawsuit with his own words just a few years ago?

Can you imagine the drama of calling Virtu’s Doug Cifu to the stand as well, to explain how NYSE charges annual rent of $264,000 to use a cable that has a one time cost of $189.50 on Amazon [virtu.com]?

These suits are fantastically gutsy moves by the Big Three Exchange Families. Do you think they will prevail? Your answer will likely boil down to whether or not you believe that the Exchanges, their lobbyists, and the politicians bought by those lobbyists have more power than the government agency charged with trying to protect you.