23

Dec, 2019

23

Dec, 2019

Robinhood Strikes Again

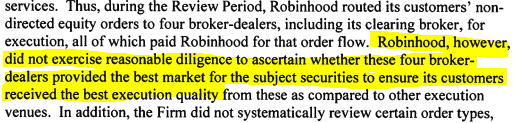

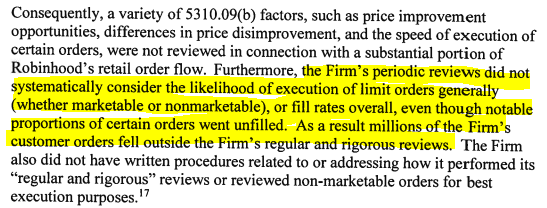

It’s been a while since we wrote about Robinhood, the broker to the millennials, so we figured we would give you an update on their latest run-in with the law. Last week, Robinhood settled with FINRA for $1.25 million for “best execution violations related to its customers’ equity orders and related supervisory failures that spanned from October 2016 to November 2017.” Considering they sport a $7.6 billion valuation , you would think that they would do a better job with their compliance of FINRA rules. Here is what FINRA found:

“FINRA found that for more than a year, Robinhood—which offers its customers the ability to trade in equity securities without being charged commissions—routed its customers’ non-directed equity orders to four broker-dealers, all of which paid Robinhood for that order flow. This arrangement is known in the brokerage industry as payment for order flow.”

While Robinhood spread the orders around to four different brokers, they seemed to have forgotten to check if any other brokers, exchanges or ATSs could give them a better execution

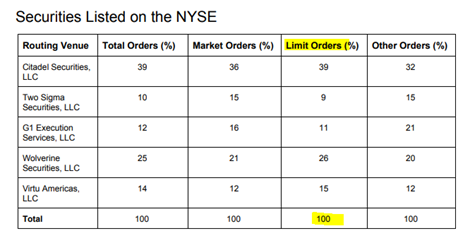

Not only was Robinhood selling 100% of their market orders to these four brokers, but they were also selling 100% their limit orders.

We took a look at their 2019 2nd quarter 606 report and it confirms that Robinhood was still sending 100% of their marketable and non-marketable limit orders to five market makers

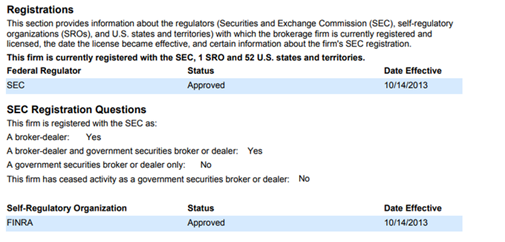

This made us wonder: Why would a significant online broker like Robinhood not be a member of any US stock exchange? Shouldn’t they just send their limit orders to an exchange rather than a market maker? According to BrokerCheck, Robinhood is not a member of any of the 13 U.S. stock exchanges:

Robinhood could be collecting rebates from the stock exchanges for these limit orders but they choose instead to send their orders to the five market makers. We’re not sure why they route this way but one reason they might be to avoid the additional regulatory oversight that would occur if they were members of an exchange.

What’s Next For Robinhood and Other Retail Brokers

On the last page of the FINRA case, Robinhood issued a Corrective Action Statement where they detailed a number of enhancements that they have taken to address their best execution violations. However, new SEC rules could soon create more problems for Robinhood and other retail brokers that sell their order flow.

Revisions to Rule 606 will now require greater disclosure of the payment for order flow that these brokers are receiving. According to the SEC , “Rule 606(a)(1)(iv) requires a discussion of the material aspects of the broker-dealer’s relationship with each Specified Venue, including a description of any terms of such payment for order flow or profit-sharing arrangements that may influence a broker-dealer’s order routing decision for the orders covered by Rule 606(a)(1). The SEC gave this example:

“For example, if a broker-dealer receives a discount on executions in other securities or some other advantage for directing order flow in a specific security to a Specified Venue, or if a broker-dealer receives equity rights in a Specified Venue in exchange for directing order flow there, then all terms of that arrangement must be disclosed including any securities covered by the arrangement with any and all terms of the arrangement specific to each security. If a broker-dealer receives variable payments or discounts based on order types and the amount of such orders sent to a Specified Venue, e.g., marketable orders, nonmarketable orders, or auction orders, then all terms of that arrangement must be disclosed. In addition, because such arrangements would influence a broker-dealer’s order routing decision, the amended rule requires disclosure of the details of any arrangement between a broker-dealer and a Specified Venue where the level of execution quality is negotiated for an increase or decrease in payment for order flow.”

We’re glad to see that the SEC will be increasing their oversight of the practice of payment for order flow and look forward to this increased disclosure.