06

Jun, 2017

06

Jun, 2017

New Academic Study: High Frequency Trading Strategies Contradicts Tired “Adding Liquidity” Pro HFT studies

Remember slides like this? LOL.

(click image for larger view)

Just over seven years ago, I was asked to participate in an SEC Market Structure Roundtable in Washington DC. Joining me on the High Frequency Trading Panel, besides HFT practitioners from RGM and Getco (and others), was Babson College’s Professor Michael Goldstein. He was notable at that time, as he asserted that the markets were trading too fast, with dubious benefit. His viewpoint was in stark contrast to the existing HFT Academic Study Consensus (see slide above).

Professor Goldstein has a new study out titled High Frequency Trading Strategies, and this morning we would like to share it with you.

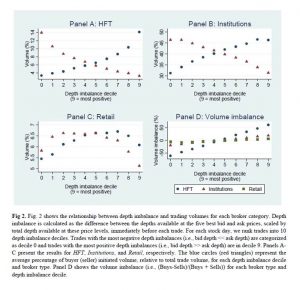

This paper, like others that have been released post-Flash Boys, demonstrates that “HFT” does not sit there, magnanimously providing liquidity for us all to interact with at our choosing, contrary to the assertions by every NYSE DMM, for example. In this paper, Goldstein examines data from the ASX post 2012, when the ASX adopted ITCH (like NASDAQ). He looked at order depth of book data from the direct feeds, and armed with participant classifications from the ASX (Retail, Institutional, HFT), was able to dissect exactly who was trading, and when.

(click image for larger view)

It turns out HFT adds liquidity on the thick side of order books, and consumes liquidity on the thin side. During periods of volatility, their use of the order book imbalances to aggress and take liquidity is more pronounced.

We find that HFT trade more aggressively and are more successful at picking off stale orders from institutional and retail investors when the market is volatile. However, by demanding liquidity from the thin side of the order book, one consequence is that HFT could potentially exacerbate future limit order book imbalances.

He adds:

HFT have a crowding out effect on non-HFT limit orders, which potentially increases non-HFT limit order execution costs.

And:

However, HFT can also use the information contained in the order book imbalance to detect institutional buying or selling pressure.

We show that HFT supply liquidity to the order book, but only to the side where there is a lot of existing depth. In contrast, we find that HFT demand liquidity from the thin side of the order book, which is more prominent in times of high market volatility.

We would like to add that Goldstein’s work here reinforces what many have been stating since 2010 – that HFT strategies did – and still do – take liquidity when its needed most, and add it when it is not. They do this by analyzing the limit order books, which include individual order attribution. This makes it easy for them to spot who is “slow” and who is “flickering”; the institutions stand out.

Feel free to download Professor Goldstein’s study; we are confident Modern Markets will not be featuring it publicly, and especially to their congressmen in Washington DC.