24

Dec, 2015

24

Dec, 2015

“Is High Frequency Trading Beneficial to Market Quality?”

Finally, after years of academic and regulatory research, a paper has been written which reveals that high frequency trading is not as beneficial to markets as its proponents claim. The paper titled “Is High Frequency Trading Beneficial to Market Quality?” was written by three academics (Philip, Kwan and Partington) from the University of Sydney. The authors focus on predatory high frequency trading which seeks to take advantage of other investor’s orders. They do think there is beneficial value to some HFT strategies such as cross market arbitrage which helps maintain efficient prices and transfers liquidity from one venue to another.

The Data

Before we get to the results of the paper, we want to make sure you understand that this paper is unique because of the data set that it uses to analyze trading. Rather than use a stale data set supplied by an exchange, the authors were able to obtain data directly from the Securities Research Centre of Asia Pacific (SIRCA) which covers the period from January 1, 2009 to August 27, 2013. The data contains every order entry, revision and cancellation as well as trades and broker ID’s for each order. Regulators in the US have yet to give this level of equity data out to researchers since user id’s are not revealed in the data feeds. Since the Australian academics had access to broker id’s, they were able to directly trace how an order/trade interacted in the market.

“The data set also allows the limit order book to be completely reconstructed so that every individual order and its queue position is known. The ability to reconstruct the full order book also allows identification of which order was supplying (demanding) liquidity for every trade without the need for approximation techniques.”

The Metrics

The authors point out that “equity markets have evolved significantly over the past 20 years, yet the metrics academics use have not.” They take issue with the three favorite metrics of HFT proponents: spreads, liquidity and volatility.

Spreads – the authors understand the “three tick boogie” and how spreads that seem to be narrowing are actually being compressed by predatory traders. They state: “By taking liquidity that should be available to the passive institutional investors, front runners profit at their expense. This is a strategy which adds nothing to market quality, yet will improve the bid/ask spread metric.”

Liquidity – the authors seem to be in agreement with the Bank of England’s Andy Haldane here. You may recall that Haldane was quoted as saying that “HFT’s supply liquidity in a monsoon and consume it in a drought”. The authors research found that “HFT are supplying liquidity on the thick side of the order book where there is already a surplus, but lees frequently supply liquidity on the thin side of the order book where liquidity is most needed.”

Volatility – the authors don’t believe that HFT reduces volatility since they say the evidence is inconclusive.

Rather than use the above metrics to analyze the effects of HFT, the authors have developed new metrics to measure market quality: probability of filling an order, time for execution and top of book imbalance (to measure the amount of liquidity supplied).

The Results

The authors believe that in 2009 (the beginning of their dataset), HFT was still in its early stages on the Australian Stock Exchange (ASX). Since they had almost 5 years of data to study, they were able to observe how their metrics changed over time.

Probability of a fill – the authors found that the probability of a fill decreased as HFT gained in popularity on the ASX:

“At the beginning of the sample period an institutional investor’s limit order is expected to execute more than 50% of the time, whereas by the end of the sample, the expected probability of execution has decreased to 30%.

Expected time to fill – the authors found that the expected time for a fill increased as HFT gained popularity on the ASX:

“This suggests that as HFT has become more prevalent that the time an institutional investor must wait for their limit order to execute has increased.”

Top of Book Imbalance – the authors found that HFT does not add “quality” liquidity:

“The conclusion from the analysis of the top of book imbalance is that when demanding liquidity HFTs make strong demands on the thin side of the order book and when supplying liquidity HFTs provide some supply on the thin side of the order book, but non-HFTs have a greater tendency to supply liquidity on the thin side of the order book.”

The Conclusions

By using new metrics and data with user id’s, the authors were able to draw much different conclusions from the usual academic research that we have seen published in the last few years. Here is their conclusion:

“We report three key findings. First, as HFT became more prevalent, the probability that an institutional limit order would execute decreased. Second, the average time taken for institutional order execution increased with HFT activity. Taken together, these two findings suggest that institutional investors are crowded out from the order book in the presence of HFT. HFTs strongly demand liquidity on the thin side of the order book and are less generous in supplying liquidity on the side of the order book where it is most needed. These results hold for all HFT firms in aggregate and at an individual level. The results are suggestive of HFT trading strategies that front run the limit orders of other traders.

HFT is on balance detrimental to market quality. Logically, if trading is zero sum game and HFT traders are making profits then it must be at the expense of other traders.”

Our Take

We hope that our summary does this report justice but we encourage you to take a look at the full paper. This report is refreshing since it challenges the status quo arguments by using robust data and new analytical metrics. We have long suspected many of the results that this paper concludes but did not have the data to prove it.

Proponents of HFT often claim that they shrink spreads and add liquidity and they usually point to the same old Brogaard and Hendershott reports to prove their case. They often will challenge us to prove our claims that we think HFT is in fact detrimental to market quality. We have been able to point to some research in the futures market by Andrei Kirilenko to prove our points but until today we have yet to see a research report on the equity market which supports our claims. We hope that our regulators use this report as a model to create their own research report with the same metrics and data.

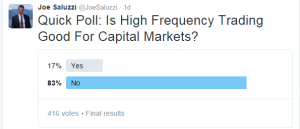

Finally, we posted a poll this week on Twitter and asked “Is High Frequency Trading good for capital markets?”. We had 416 people respond and the results were an overwhelming “NO”.

Even without this new research, investors already knew that they were being fleeced. But it’s nice to have a report now that we can reference as proof of our anecdotal evidence.