17

Aug, 2016

17

Aug, 2016

How Will You Be Using IEX Once They Transition from an ATS to an Exchange?

This morning we would like to tell you how we are planning to make use of IEX as a registered stock exchange. Beginning this Friday, IEX’s displayed quote (which we have already been experimenting with for months) will become protected. This means that if they are at the NBBO, other market centers, will have to route to them, as well as brokers.

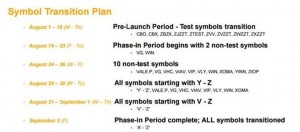

IEX Exchange Protected Quote Phase-In

First, please be aware of their phase in schedule, and the stocks that are involved:

Second, please be aware of their displayed liquidity pricing; it’s free. No take fee. No rebate.

Will All Your Brokers Be Programming to Interact with IEX in Your Best Interests?

You need to check individually with all your brokers and electronic providers. The degree of engagement might vary quite a bit. We can only speak to how we will interact with them, and why. Other brokers might own competing dark pools, or have their own internalization desires, or might do business with liquidity providers who may not be particularly IEX-friendly.

We have heard that some brokers are inclined to not make full use of IEX’s displayed liquidity offerings, except as required by Reg NMS, as they might want to take a “wait and see” approach. We have heard that some brokers will classify IEX a “grey pool” which ignores the innovation they have created with D-Peg. You may draw your own conclusions as to what might be those brokers’ reasoning and real concerns and motivations. Again, we will just focus on our own behavior, and of course explain our own reasoning.

How Does Themis Currently Use IEX – the ATS?

Themis has been an active IEX ATS dark pool user since its inception. Here is a summary of how we use them in various instances:

- IEX Router to remove liquidity (at times will IOC Midpoint ping IEX only prior to crossing the spread).

- Resting orders using IEX D-Peg.

- IEX displayed orders (icebergs- showing various displayed sizes, with larger share quantities in reserve).

- IEX only passive orders with minimum quantities.

- Combinations of the above.

- Combinations of the above combined with strategies on other venues (i.e. rest D-Peg dark, and bid or offer on inverted venues in concert).

How Will Themis Use IEX as a Full-Fledged Protected Stock Exchange?

- Themis will use its current engagement as a starting template.

- We will continue to use IEX D-Peg to rest large orders, transitioning away from using any Midpoint Pegs. We believe that IEX will outperform all exchanges with respect to midpoint and non-displayed trading.

- Posting displayed on IEX with reserve (possibly in combination with a D-Peg order as well). This will entice routers to route to IEX, and certain brokers will oversize IEX due to their large quantity of resting non-displayed interest. In addition, IEX does not pay rebates and we do not anticipate a long queue, which will benefit our clients with passive fills (with minimal negative selection, like there is on the large rebate exchanges).

Why Use IEX to Post My Bids and Offers?

This is our thought process. IEX has won a very contentious battle against a plethora of status-quo players (competing exchanges, dark pools, prop traders – even Larry Tabb) to get to this point (exchange-approval). While they are not the perfect venue to execute all of your institutional orders (and they are not trying to be), they are doing everything right to create a playing field that satisfies many different stakeholders.

- They don’t charge for or sell speed (colocation, data services, etc.)

- They don’t have maker taker, or have “liquidity partners” who received extra perks.

- They have no Post Only Day ISO to help high speed clients be first in line at EVERY tick change.

- On the contrary they have mechanisms (speedbump – D-peg) to protect against any participant, investor or market maker, trading at a stale quote.

Additionally, posting displayed liquidity always has a price. If you post an offer to sell on any exchange that is protected, wholesalers will shoot off your quote

(If they have a buyer order they purchased from an online broker, to buy stock at your displayed price, they will match your offer rather that route to you).

If you offer hidden (limit or midpoint) on any other stock exchange, they price you versus the SIP, while simultaneously arm their large volume clients to be faster than their own pricing convention.

If you offer on other exchanges, you immediately are joined/penny-jumped by high speed short term traders.

If you offer on IEX displayed, its speedbump will discourage many high speed players whose main trading strategy is to pick off what they perceive as a slow quote. This is not a bad thing.

We have been experimenting for several months trying different strategies with IEX displayed. Our experience to date is positive. We think it will prove an excellent tool and destination in our quest for “best execution”. We not only believe this for how we trade at Themis, we also believe it wise to share our thoughts and tactics with you – our clients.

Clean trading breeds clean trading. Clean destinations become cleaner as more clean players up their participation. It is to all of our best interests to use this IEX opportunity to make sure the rest of “The Street” knows that we ultimately own the marketplace, and that we will reward players who act in our best interests.

Please, have conversations with your trusted brokerage partners, and feel free to let them know how you want to interact with IEX. How you want to act will not necessarily coincide with how they want to act. While you may want to rest, and to use IEX displayed, they may want to send out an occasional IEX midpoint IOC ping. Stark difference.