17

Jul, 2017

17

Jul, 2017

Senator Warner Turns Up The Heat On The SEC

There is not much market structure talk coming out of the U.S. Senate these days. The two senators who did focus on market structure (Sen. Ted Kaufman and Sen. Carl Levin) are now both retired. However, there is one senator, Senator Mark Warner (D-VA), who has occasionally focused on market structure issues. During SEC Chairman Jay Clayton’s confirmation hearing in March, Sen. Warner pressed him on the issue of rebates and the maker/taker model. Sen. Warner has said that he believes the current exchange rebate fee schedule is a way to “game the system”. He mentioned in the confirmation hearing that he had pushed former SEC Chair White to move forward on a maker/taker pilot program but did not see any results and wanted to know if Mr. Clayton would work with him on this issue. Mr. Clayton agreed that he would look at the issue and work with Sen. Warner on it.

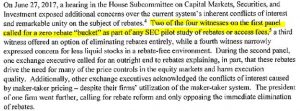

On July 14th, Sen. Warner sent a letter to SEC Chairman Clayton where he continued to put pressure on the SEC to finally address the rebate issue. In the letter, Sen. Warner noted that he appreciates the EMSAC work on the issue, but that recent data and industry comment “increase and accelerate the need for reform”. The industry comment that he was referring to was from the House Financial Services hearing on June 27, 2017. Sen. Warner noted:

We’re very happy that Sen. Warner referred to this hearing and we’re even happier that one of the voices he cites as raising concerns about rebates was that of Themis Trading. We think that our comments about the full elimination of rebates made an impression with Sen. Warner. No longer is he just calling for an access fee pilot, but now he is demanding the full elimination of rebates:

He then goes one step further and writes that the SEC could eliminate rebates for liquid stocks immediately. Sen. Warner cites the “years of discussion and broad recognition of harm” as the reason why the SEC could do this now. This is a very smart move by Sen. Warner because he seems to be sensing that Chairman Clayton is not looking to move swiftly. He knows that the industry is calling for “holistic reviews” before any major market structure reforms are undertaken. Sen. Warner is trying to prevent the industry from slowing down reform that can be done swiftly by the SEC.

It’s interesting to note that while Sen. Warner has cited the exchange rebate schedule as a source of conflicts of interest, he is calling for the “full elimination of rebates“. We read this as not only eliminating exchange rebates but also the rebates that market makers pay to retail brokers for order flow. This is exactly the letter we were hoping to see written by a senior legislator. The pressure is now on Mr. Clayton to respond.