14

Aug, 2017

14

Aug, 2017

Immunity Now!

As you all know, stock exchange business models have morphed radically in the last decade. Large portions of their business are bed-rocked in the selling of speed (colocation, data feeds, and data services) – as much as 50%.

And as you all know, this morphing has been put in the spotlight with the public’s awakening to the role that high frequency trading plays in our modern equity markets. In the wake of Flash Boys and the arrival of IEX, class action lawsuits have emerged, including the suit against seven stock exchanges along with dark pool operator Barclays. In that suit, it is alleged that the exchanges gave high frequency traders an unfair advantage, providing them with data sooner than other traders. Judge Furman threw out that lawsuit, claiming that the stock exchanges had absolute immunity, as their actions fell within their “quasi government powers.”

Subsequently, the SEC weighed in by filing an amicus brief, saying that the SEC had no authority to adjudicate such lawsuit, and that immunity only applied when a stock exchanges acted as a regulator, and not as an operator of a market. Said differently, the SEC claimed that exchanges are not entitled to absolute immunity arising from commercial activities – such as selling colocation and fast/enriched data feeds.

This obviously has been weighing on the big stock exchange executives’ minds, including Atlanta-based ICE’s Jeff Sprecher.

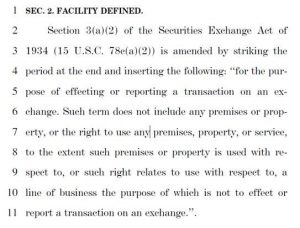

This morning we want to alert you to a new bill put forth – HR 3555 – which seeks to amend the Securities Exchange Act of 1934 by redefining the “facility of an exchange” so as not to include any facility that does not “report a transaction on an exchange”. The bill is short, effectively adding this paragraph to the Exchange Act:

The bill is put forth by Representative Barry Loudermilk from Georgia’s 11th district, who issued this statement:

“Regulatory agencies have a tendency to expand their reach into areas they should not be regulating and engage in mission creep, which can stifle innovation. As a small business owner, we embraced new technology and used it to benefit our customers. Instead of trying to make new ideas fit into old, one-size-fits-all regulations, agencies should adjust to allow business and individuals the opportunity to grow. In order to update the Securities Exchange Act of 1934, I introduced H.R. 3555, the Exchange Regulatory Improvement Act. Georgia companies face compliance burdens on parts of their businesses that should not be regulated as exchanges, and this bill will put guardrails on the agencies to prevent overregulation. We need a new, fresh approach, and this bipartisan legislation will go a long way in bringing a 1930s law into the 21st century.”

Background

- R. 3555, the Exchange Regulatory Improvement Act, proposes to update the definition of a “facility” of a stock exchange under the Securities Exchange Act of 1934, to account for new business models that have been developed by stock exchanges in the years since the law was written.

- Various stock exchanges have recently established subsidiaries involving data management services, regulatory compliance technology, and others.

- The bill clarifies that a facility of an exchange does not include businesses that are not “for the purpose of effecting or reporting a transaction on an exchange” for regulatory purposes.

- This bill will ensure that business activities that are unrelated to effecting or reporting a transaction on an exchange are not subject to regulation as an exchange. However, the bill will not exempt functions of exchanges that are material to securities trading from Securities and Exchange Commission supervision, such as market data, listing standards, and colocation.

- Original co-sponsors of this legislation are Rep. David Scott (D-GA), Rep. Randy Hultgren (R-IL), Rep. Greg Meeks (D-NY), and Rep. Lee Zeldin (R-NY.)

Loudermilk’s district does include Atlanta, home of Jeff Sprecher’s Intercontinental Exchange.

Loudermilk’s bill appears to protect ICE (NYSE) from investor lawsuits arising from high frequency trading and unfair advantages. It’s apparent intent is to bypass the SEC’s role in protecting investors, by making an end-run around them in Congress. The addition of that one paragraph to the Securities Exchange Act of 1934 would prevent the SEC from acting as a regulator and policeman of stock exchanges on any issue around the selling of speed.

Is the bill in the best interests of investors? Make your own decision, of course. And always remember the words of Calvin Coolidge – “the business of government is business.”