01

Sep, 2017

01

Sep, 2017

Robin Hood – The Legend of Internalization – Part II

It’s been a while since we wrote about the brokerage firm Robinhood so we wanted to check back in to see how they have been doing. According to this Business Insider article with their co-founder Baiju Bhatt, business at the zero-commission brokerage firm is booming. They now sport a $1.3 billion valuation and have over 2 million users and are enjoying 20% growth month over month in their margin loan business.

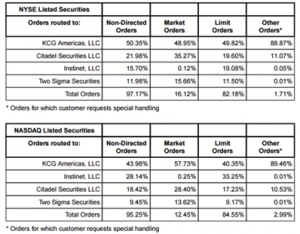

So how does a firm that charges zero for commissions command a $1.3 billion valuation? In addition to the margin business, they receive payment for order flow from market makers on every order that trades. When we last checked in on Robinhood in January 2016, here is what their 606 disclosure of order routing report looked like:

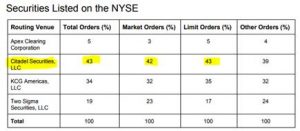

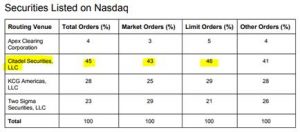

A year and a half later and their 606 report now looks like this:

As you can see, Citadel has almost doubled their market share of Robinhood business. Most of Citadel’s increase has come at the expense of KCG which has seen their Robinhood business cut nearly in half over the past 18 months. Why does Citadel receive almost 50% of all of Robinhood’s orders? Maybe it’s because they pay the highest amount per share for the orders. According to their most recent 606 report, Robinhood received payments from Citadel which “averaged less than $0.0015 per share for order flow executed in the second quarter 2017.” This is $0.0003 higher than the payment they received from KCG.

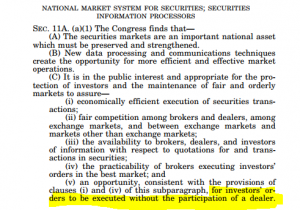

Robinhood sells all of their client orders to market makers, including market and limit orders. These orders never have the chance to interact with the market without the participation of a dealer. We wonder if sending all of their retail client orders to a dealer violates Section 11A of the Securities Exchange Act of 1934 which states:

If the Exchange Act says it’s in the public interest and appropriate for the protection of investors and the maintenance of fair and orderly markets for “investors’ orders to be executed without the participation of a dealer”, then how is it acceptable that Robinhood (and other retail brokers) sends all of their orders to market makers without first giving these orders a chance to interact with other market participants?