02

Mar, 2022

02

Mar, 2022

The PFOF Defenders

The big market makers may tell you that you don’t have the facts and the data. They may say that they have saved retail investors billions of dollars with their price improvement.

These statements are often echoed by some of the largest retail brokers who have collected billions of dollars from payment for order flow (PFOF). These same brokers also claim that they are “democratizing finance” even though they have been hit with repeated regulatory violations.

Industry friendly market structure consultants will also write reports and articles that claim “retail investors don’t care about PFOF”. Other consultants will scoff at any suggestion of a ban on PFOF and will point to cherry-picked statistics showing the “savings” from price improvement.

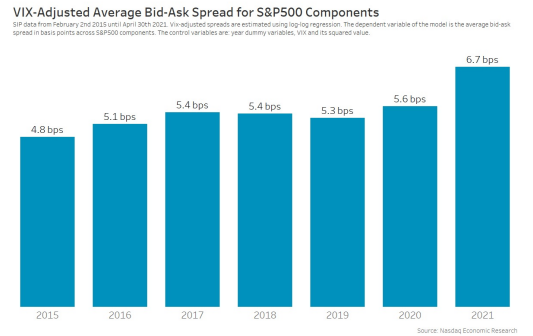

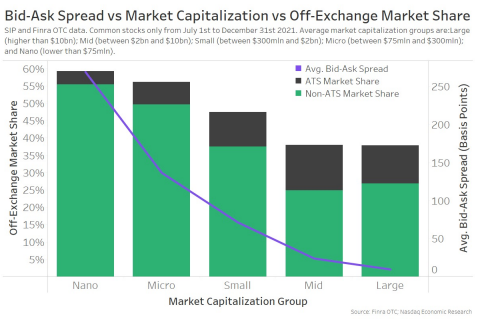

However, these status quo market structure defenders never seem to include charts like the ones recently produced from Nasdaq that tell a different story which is that the retail investor may have actually had it better in the past. The following two charts show that spreads have actually been widening during the zero-commission era:

Retail and institutional investors know that there is something rotten about free commissions and payment for order flow. A new article written by an economist named John Summa and titled “The Lure of Democratizing Finance” does a really nice job explaining why investors should be concerned about PFOF. The article recaps the SEC’s Meme stock report and also references the research report from Hitesh Mittal and Kathryn Berkow from BestEx Research titled “The Good, the Bad & the Ugly of Payment for Order Flow”. Also included in this article is an order routing analogy from our friends at Better Markets :

“Imagine if you shopped at Amazon all along believing that the rules of the market required Amazon to automatically route you to the seller with the best priced widget only to find out later that it routed you not to the best available price but instead to a worse price. Furthermore, imagine if Amazon gave you this worse price with little or no explanation of what it was doing and even accepted hundreds of millions of dollars from the retailers selling you the widgets in exchange for sending your orders to be filled at the worse price … rather than a lower best price. Finally, to add insult to injury, imagine that Amazon repeatedly asserted in an almost Orwellian fashion that it was doing you a favor—providing you “price improvement”—by sending you to sellers paying Amazon to provide you with worse prices. Everyone would correctly see that practice as wrong, but that is in effect how the PFOF practices work.”

The article concludes with this warning:

“Far from undermining the Wall Street establishment by leveling the playing field, zero-commission trading—now the new normal among retail brokers—has instead provided today’s biggest financial capitalists with a new way to siphon wealth from average Americans, without them even knowing.”

Investors do indeed care about the practice of payment for order flow. They know that if you are not paying for something, then you are not the customer…you are the product. They know that there is no free lunch. They may not have all the data but they know they are getting fleeced.