22

Nov, 2022

22

Nov, 2022

Stock Exchange Incentives and the Two-Dollar Rip

While retail PFOF gets most of the media attention, most of the major stock exchanges also offer order routing incentives in the form of rebates. These rebates often vary based on volume as well as the type of order that was used to execute a trade. Over the years, the exchange rebate/fee schedules have continued to get more complex as incentives continue to been added for their best customers. If you want to get a sense of how ridiculous this has become, take a peek at the 26-page NYSE price list.

In addition to transaction rebates, some exchanges also offer monthly quoting incentives to market makers (DMMs) for quoting exchange-traded products (ETPs) that are listed on their exchange. The NYSE just proposed adding this new DMM incentive :

“In order to encourage quoting on the Exchange in listed ETPs, the Exchange proposes to offer monthly quoting credits to DMMs in assigned ETPs. Specifically, the Exchange proposes that DMMs quoting 30% or more of the time in a billing month in an ETP assigned to that DMM on the last day of that billing month would be eligible for a credit of $4,000 per assigned ETP for that billing month. DMMs quoting less than 30% of the time in a billing month in an ETP assigned to that DMM on the last day of that billing month would be eligible for a credit of $2,000 per assigned ETP for that billing month. As proposed, DMMs would be eligible for the credits for the first 12 months following the listing of the ETP on the Exchange while that ETP is listed on the Exchange.”

Depending on how many ETPs that a DMM has been assigned, these monthly incentives could add up to a significant amount of money. According to the NYSE filing, DMMs are being compensated “to encourage higher levels of liquidity and quoting by DMMs on the Exchange in listed ETPs, which would support the quality of price discovery on the Exchange and is consistent with the overall goals of enhancing market quality.”

Sounds great…more liquidity, better price discovery. Not so fast. While NYSE has placed a 30% minimum NBBO quoting time to capture the maximum incentive, they said nothing about having minimum quotation times. In other words, high speed market makers can cancel their quotes any time they like during the day. Considering that these firms have excellent technology that can react in nanoseconds, we would expect that they would often cancel these “liquidity providing” orders when the market is about to move against them.

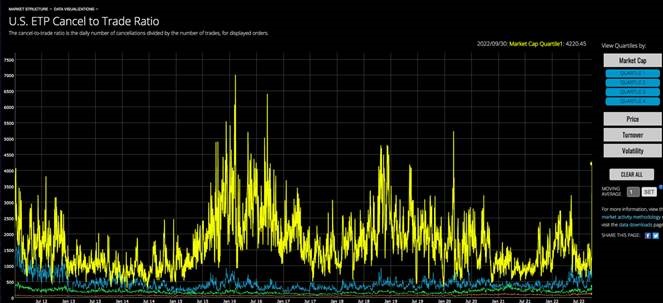

Rather than be accused of being critical of the market maker community without having the data to back it up, we went to the SEC’s Market Structure Analytics website to check on the cancellation ratio of ETPs. As we suspected, the cancellation ratio in ETPs is extremely high. The below chart shows the US ETP cancel-to-trade ratio broken down my market cap quartile (ETPs in the top quartile had a recent cancel-to-trade ratio of 4,220 to 1):

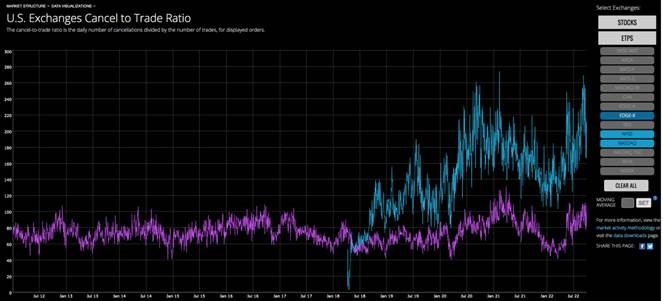

We then took a look at just the US ETP cancel-to-trade ratio for trades done on the NYSE and Nasdaq. As you can see from the below chart, ETP cancellations are much higher on the NYSE (blue line) than they are on Nasdaq (purple line).

Our Thoughts

How does NYSE fix this high cancellation problem? Of course, the answer from the major exchanges always seems to be to increase rebates and incentives and then claim that liquidity has increased. However, since market makers don’t have a minimum quoting time and can cancel anytime they wish, we doubt that a new monthly incentive program is going to improve liquidity for these ETPs.

Rather than exchanges trying to manipulate ETP quotes with market maker incentives, we think the market should decide if an ETP is worthy to continue its listing. If investors feel that the ETP fills a niche and helps their portfolios, then the ETP will increase liquidity organically. If not, volume will diminish and the ETP should be delisted. Two-dollar rips are for Boiler Rooms and should not be part of any stock exchange pricing program.