09

Nov, 2022

09

Nov, 2022

The Fragility of HFT Liquidity

For years, we’ve been talking about the dangers that high frequency trading has brought to the US equity market. We’re sure that sometimes we sound like a broken record, but the dangers of HFT and their disappearing liquidity have not gone away. In addition to the dominating the US equity market volumes, HFTs have infiltrated and dominated most other markets including some parts of the US Treasury market. In their just released semi-annual Financial Stability Report, the Federal Reserve raised concerns about how some areas of the US Treasury market have become overly dependent on HFT liquidity and what could happen to that liquidity during volatility spikes.

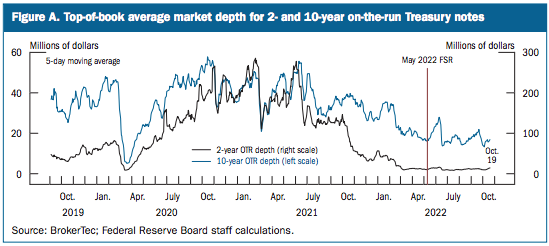

The Fed is most concerned about the on-the-run Treasury securities market, “where trading takes place predominantly on platforms employing central limit order books (CLOBs)”. They observed that “the reduction in market depth for shorter-maturity securities was relatively large—to levels around the low point seen during the onset of the COVID-19 pandemic”. Here’s a chart that shows the drop in market depth:

In particular, the Fed warned about the fragility of liquidity that is supplied by HFTs:

“Moreover, the continued low level of market depth means that liquidity remains more sensitive to the actions of liquidity providers that use high-frequency trading strategies to replenish the order book rapidly. Greater concentration of liquidity provision among firms that may follow similar strategies can be a source of fragility, making it more likely that liquidity could further deteriorate sharply in response to future shocks.”

One of the best descriptions of HFT behavior that we have ever seen came from a 2011 speech from the Bank of England’s Andy Haldane where he said:

“Far from solving the liquidity problem in situations of stress, HFT firms appear to have added to it. And far from mitigating market stress, HFT appears to have amplified it. HFT liquidity, evident in sharply lower peacetime bid-ask spreads, may be illusory. In wartime, it disappears. This disappearing act, and the resulting liquidity void, is widely believed to have amplified the price discontinuities evident during the Flash Crash. HFT liquidity proved fickle under stress, as flood turned to drought.”

In other words, market participants shouldn’t depend on HFT liquidity because it won’t be there when you truly need it.

Why should equity traders care about low levels of liquidity in the US Treasury market?

Simply put, disappearing liquidity in the Treasury market causes volatility that often spills over very quickly to other markets. The Fed noted in their report:

“Similar to the market for on-the-run Treasury securities, market depth in all of these other markets remains historically low, suggesting that in these markets, too, liquidity providers have replenished limited volumes of quotes sufficiently rapidly to prevent outsized moves in the best quoted prices over short periods. Nonetheless, these conditions suggest a higher-than-normal risk that bid-ask spreads may widen in the face of further shocks, making prices even more volatile.”

Since today’s electronic markets are so inter-connected by low-latency algorithmic trading, markets tend to move instantaneously with each other. Considering how much focus over the past year that has been put on the bond market and interest rates, HFT induced liquidity vacuums in the US Treasury market are likely causing extra volatility in the stock market.